Given recent and ongoing events surrounding the collapse of FTX and the wider implications on the crypto space, not to mention disillusion with what many are seeing as malpractice, what should people look for when signing up to an exchange?

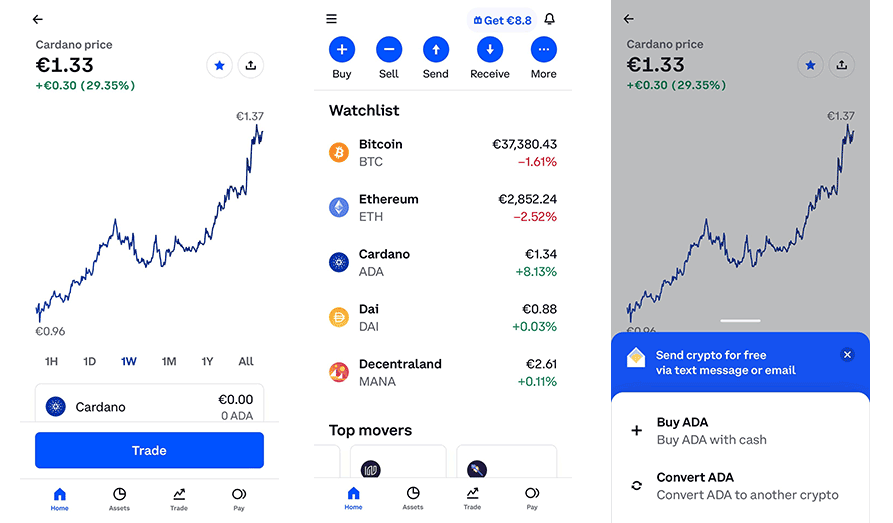

There is increasing interest in cryptocurrencies as many seek to explore innovative blockchain technology. The starting point for all with prior or no experience is through a crypto exchange. They are market makers and allow buyers and sellers to link for various trades. Various factors come into play when considering which crypto exchange to use. Crypto traders have their inclined preferences, but what is constant in everyone’s choices is trust. Crypto Lists delves deeper into what determines that a crypto exchange is trustworthy to trade your preferred coins and tokens, including Bitcoin, Ether, and other big hitters.

Go directly to

1. An Extensive Operation Period

Similar to how you would not easily open a bank account with an institution that just opened its doors, the same applies to a crypto exchange. A well-established crypto exchange that has stood the test of time is more trustworthy than a recently launched one. The crypto craze opened an opportunity for fraudsters and scammers to prey on crypto users exploring the industry for the first time. With so many new ones opening up, it can be challenging to determine a genuine and reputable exchange. Newcomers might be best to begin with exchanges that have been in the business for a while and have built trust with their customers. You can check reviews online on places like Crypto Lists as well as doing additional research.

2. A Good Operational Reputation

A crypto exchange may be around long enough. What is even more important is the reputation it has. It is critical to research other users’ experiences to gauge the trustworthiness of the exchange. Crypto Lists shares reviews for educational purposes, and seasoned veterans of the space on social media usually tell their followers which trading platforms they use.

The liquidity reputation of the exchange assures users that they can easily trade at any time. A high-volume order coincides with a large user base and regular traders. Liquidity exudes confidence in trade even during high volatility.

In your research, be on the lookout for any incidents in the history of the exchange’s operations. These include reports of scams and hacks that risk your funds. If any of these exist, the response in addressing such incidences will portray how trustworthy they are. Some exchanges provide insurance for customer funds in case anything unforeseen occurs. It assures investors who may not be familiar with the exchange.

Rating: 9.3/10

Number of instruments: 39+ instruments

Description: Sign up to one of the most regulated and reputable brokers in the world.

Risk warning: The crypto market is volatile. Don’t risk more money than you can afford to loose.

3. Details on the Background of the Team and Founders

The background of the team running the exchange plays a critical role in its operations. Accessing this information is critical as some exchanges do not provide information regarding their team or founders. Providing easily verifiable information on its team is a good way build trust with its users for accountability. Many decentralized exchanges have limited to no information on their team and founders. While there are reasons for this, such as the original ideas of anonymity and freedom of regulation underpinning cryptocurrencies, it can be understandably off putting to new entrants to the space. Because customers trust them to maintain a high level of security and liquidity, a team with prior experience and relevant skills in the crypto industry builds confidence in opening an account.

4. A Reputable Licensing Jurisdiction

Several exchanges exist and operate in various jurisdictions. Those wishing to display trust with its users often seek licenses from reputable jurisdictions such as the USA, UK, and the EU. These jurisdictions highly consider consumer protection from manipulation by exchanges.

Exchanges receiving licensing jurisdiction from Singapore or the Caribbean, including the Bahamas, have built a negative reputation that its users are cautious of. Licenses from reputable jurisdictions build trust with customers on the funds deposited into the exchange. This means that there’s slim chance of withdrawals halted or your assets being frozen in the event of a problem.

5. An Effective and Transparent Customer Support

Exchanges providing prompt and effective customer support ensure that members’ queries and uncertainties about the exchange are addressed. These are in the form of live chat support, an available email address, or phone contact. New users may have many queies and wish to avoid challenges beforehand. The reputation of the exchange’s support is critical as the crypto market is extremely volatile and delays in support responses may cause financial impact to the user, in the worst cases.

The support of the exchange must ensure there is transparency, especially in matters regarding transaction fees. It should convey to its users of any discounted fees for using the exchange’s native token if it exists. Fees directly impact your investment portfolio. Additionally, it must also disclose processing times, physical address, and jurisdiction. Exchanges that are evasive on such matters cannot be trusted with investors’ funds.

Crypto Lists reviews many of the reputable exchanges that you can start with as a beginner or experienced pro.

Supply: 118,780,000 / 200,000,000

Release date: August 1, 2014

Description: Buy Ether and benefit from the power and innovation of the Ethereum network.

Risk warning: Trading, buying or selling crypto currencies is extremely risky and not for everyone. Do not risk money that you could not afford to loose.

Disclaimer: Crypto is extremely volatile and not suitable for everyone to invest in. Never speculate with money that you cannot afford to lose. The information on this site is presented for educational purposes only and should not be construed as investment or financial advice.

Enjoy midweek fun on ETH Casino with zero KYC ever

Enjoy midweek fun on ETH Casino with zero KYC ever 3 Ethereum casinos to rake back those Ether losses on!

3 Ethereum casinos to rake back those Ether losses on! Try a USDT-focused casino today on Tether Bet!

Try a USDT-focused casino today on Tether Bet!