In a move that could set a precedent for other countries, Portugal’s regulators have granted the first crypto license to a bank. The Bank of Portugal has given the go-ahead for Banco de Portugal to start working with blockchain technology and issuing digital assets.

Crypto Lists Ltd thinks this is a major step forward for the cryptocurrency industry, as it shows that traditional financial institutions are starting to embrace the notion of working with such commodities.

Go directly to

- 1 What This Means for the Future of Crypto

- 2 Portugal to Announce Its Blockchain Strategy in June 2022

- 3 What Types of Digital Assets Will Be Issued

- 4 What Blockchain Technology Will Be Used For

- 5 How This Move Could Influence Other Countries

- 6 How Will Consumers Adapt to This Transition

- 7 The Bottom Line

What This Means for the Future of Crypto

This move by the Portuguese regulators is a positive sign for the future of cryptocurrency. This could lead to more banks and other financial institutions around the world beginning to work with crypto. Furthermore, it would provide more legitimacy to the industry and make it easier for people to buy, sell, and use digital assets.

Portugal to Announce Its Blockchain Strategy in June 2022

In June 2022, the Portuguese government is likely to reveal its blockchain strategy. This will be a comprehensive plan that will lay out the country’s regulations and guidelines for blockchain tech and digital assets. With this move, Portugal is positioned to become a leader in the industry.

In April 2020, the country announced plans to establish Technological Free Zones (ZLTs), areas in which companies can test products and services, as part of its digital transformation plan. The country stated that it was investigating the use of blockchain technology during this time.

What Types of Digital Assets Will Be Issued

The types of digital assets that will be issued by Banco de Portugal have not yet been announced. However, it is likely that the bank will issue both fiat-backed and stablecoins. Fiat-backed cryptocurrencies are those that are pegged to a traditional currency, such as the US dollar or the Euro. Stablecoins, on the other hand, are digital assets that are designed to maintain a stable value.

It is also possible that the bank will issue other types of digital assets as well, such as security tokens. Security tokens are a type of cryptocurrency that represents ownership in a company or asset.

Rating: 9.3/10

Number of instruments: 39+ instruments

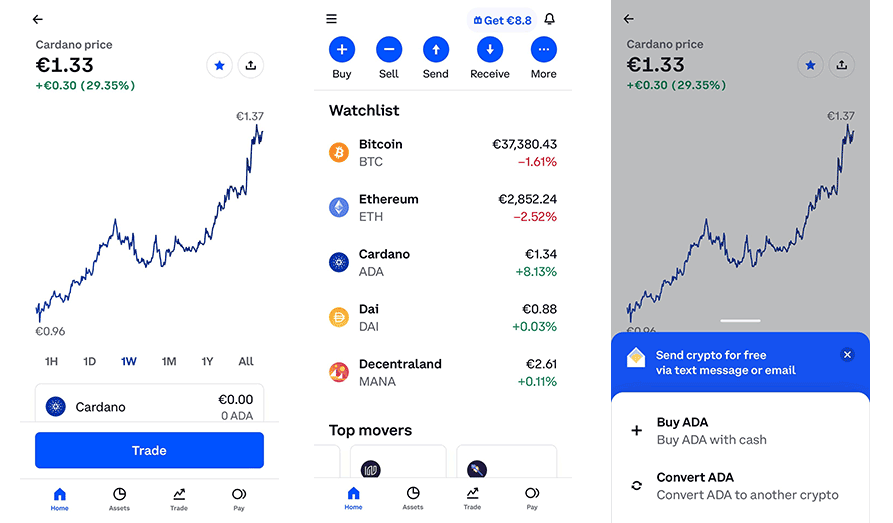

Description: Are you interested in crypto? Try CoinBase today!

Risk warning: The crypto market is volatile. Don’t risk more money than you can afford to loose.

What Blockchain Technology Will Be Used For

The Bank of Portugal has not yet announced what blockchain technology will be used for. However, it is likely that the bank will use blockchain to issue and manage digital assets. Additionally, blockchain could be used for other purposes, such as tracking payments and verifying transactions.

How This Move Could Influence Other Countries

This move by Portugal’s regulators could influence other countries to take a similar approach. In particular, this could pressure other European Union countries to provide more clarity on their own regulations for cryptocurrency. This could lead to a more unified approach to regulating digital assets within the EU.

In addition, this move could also pressure other countries around the world to reconsider their approach to cryptocurrency. For example, China has taken a hardline stance on crypto, but this could change if other countries start to issue licenses to banks and financial institutions.

Time will tell how this move by Portugal’s regulators will impact the industry as a whole though. However, it is clear that this is a positive step forward for the adoption of digital assets.

How Will Consumers Adapt to This Transition

The adoption by consumers is likely to be a gradual process. Some people may be hesitant to use digital assets because they are not familiar with them. Additionally, people may be concerned about the security of digital assets. However, as more people become familiar with digital assets and as more companies begin to accept them, the transition to digital assets is likely to increase.

In the meantime, Banco de Portugal has said that it will work with other banks and financial institutions to ensure that digital assets are used in a safe and secure manner. This will help to build trust in digital assets and increase their adoption by consumers.

The Bottom Line

The Portuguese regulators’ decision to grant a crypto license to a bank is a positive sign for the future of cryptocurrency. This could lead to more banks and financial institutions around the world embracing blockchain technology and digital assets. Furthermore, this could pressure other countries to reconsider their approach to cryptocurrency. With June fast approaching, it will be interesting to see how this story develops.

What are your thoughts on Portugal’s move to issue a crypto license to a bank?