The United States cryptocurrency exchange, Coinbase, has formally received regulatory approval from the De Nederlandsche Bank (DNB), the central bank of the Netherlands.

This approval facilitates the crypto exchange company to offer crypto products to individuals and businesses in the country. It is now a legal crypto service provider in the region. It is among the first prominent crypto exchange to receive registration from the Central Bank of the Netherlands. This is a significant milestone in Coinbase’s continued international expansion.

Coinbase Regulatory Approval in the Netherlands

Coinbase officially announced its registration to the Netherlands on Thursday 22nd September 2022. The largest crypto exchange in the US will offer its retail, institutional, and ecosystem crypto products to the country. As per official records of the Dutch Central Bank (DNB), Coinbase is one of the major international exchanges approved by the Dutch central bank to operate cryptocurrency services together with smaller local crypto firms. DNB’s public register has Coinbase Europe Limited and Coinbase Custody International listed as crypto service providers.

The DNB is supervising these listed Coinbase crypto service providers in compliance with Anti-Money Laundering (AML), Anti-Terrorist Financing Act, and the Sanctions Act. The crypto services of Coinbase are not subject to prudential supervision by the Dutch Central Bank. There is no monitoring of financial and operational risks related to crypto services. There is also no particular financial consumer protection.

Coinbase registration approval follows DNB publishing a guide committed to policy on sanctions screening for crypto transactions on September 16th, 2022. The publication was in form of a Q&A document where the Dutch Central Bank cautioned on various risks associated with cryptocurrencies, including the anonymity.

![]()

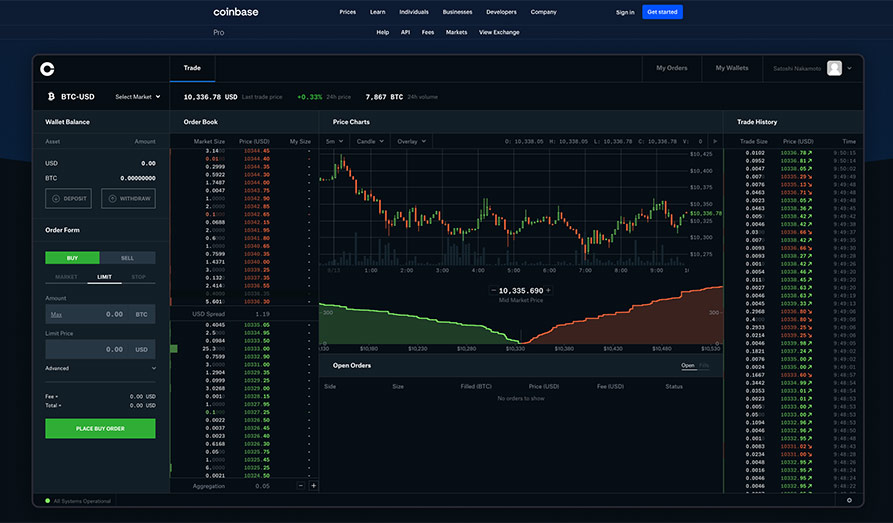

Rating: 9/10

Number of instruments: 29+ instruments

Description: What do you know about Coinbase Pro? Learn more about the most advanced version from Coinbase here!

Risk warning: Trading, buying or selling crypto currencies is extremely risky and not for everyone. Do not risk money that you could not afford to loose.!

The win of regulatory approval from the Dutch Central Bank means that Coinbase will eventually offer its services to the entirety of the European Union. This will be effected once the European Union’s Market in Crypto Assets( MiCA) is implemented and Coinbase can expand to the other 26 EU nations. Crypto Lists is aware that the EU finalised the full details of the legislation earlier in the week. Coinbase confirmed that registration and licensing applications are underway in several other major markets.

Nana Murugesan, the Vice President, International, and Business Development at Coinbase noted the initiative to obtain registration in the Netherlands aligned with the company’s compliance-led business motto. He went further to elaborate that it is part of Coinbase’s ambition to be the world’s most trusted and secure crypto platform. The firm is taking the initiative to collaborate with governments, policymakers, and regulators to shape the future responsibly. He unveils that the Netherlands is a significant international market for crypto. The VP expressed his excitement about Coinbase offering the potential of the crypto economy to the Dutch market.

Coinbase expansion into Europe

Crypto Lists notes that Coinbase has been traversing throughout Europe and it currently carries out operations in over 40 European countries. Its entrance into the Netherlands follows the company’s aggressive expansion into Europe. It had earlier indicated in June that it will move into Europe citing the effects of a significant decline in crypto markets.

The Italian AML regulator, Organismo Agenti e Mediatori, provided Coinbase with a Crypto Asset Service Provider in July. The crypto exchange also plans to register in Spain and France. The 40 European countries it has traversed include dedicated hubs in Ireland, the United Kingdom, and Germany.

The aggressive expansion of Coinbase is amidst the company facing some challenges. It has incurred significant losses in consecutive quarters in 2022. Q2 losses amounted to $1.1 billion. It is the highest loss it has recorded since being listed on the Nasdaq Stock Exchange last year.

Its Europe expansion is similar to its rival crypto exchanges Binance, which is registered in France, and Bitstamp registered in Italy. They continue to gain regulatory approvals in individual countries in 2022. There is a strong perception that this would assist it in operating across the EU after the implementation of the MiCA regulations into law.

Adoption of Crypto in the Netherlands

The cryptocurrency industry is realising that regulation and adoption go hand in hand. Crypto has evolved together with the perception by governments. Several governments have been more accommodating towards crypto whereas others remain hostile. It is increasingly essential for exchanges to operate in particular regions to increase their user base and legal conditions. The Netherlands has thankfully not been as stringent with crypto regulations. It currently does not prohibit crypto trading or its use in the region.

![]()

Rating: 9/10

Number of instruments: 29+ instruments

Description: Have you tried the Coinbase App? Now, it’s also regulated from Netherlands in the European Union.

Risk warning: Trading, buying or selling crypto currencies is extremely risky and not for everyone. Do not risk money that you could not afford to loose.!