Cryptocurrencies are known to be highly volatile, and that is why stablecoins were invented. Stablecoins use the security of blockchain technology and pegs the token's value to the US dollar. This helps traders to hedge off any sudden price movements of the cryptocurrency; thus, enabling them to gauge their profitability with more precision. In the current crypto space, Binance USD is the major stablecoin, along with USD Coin (USDC), Tether (USDT), and the Dai tokens (DAI). This article will discuss what Binance USD is, the costs associated with it, its reputation, as well as its pros and cons. Read on to find out more about this cryptocurrency.

A Bit About Binance USD

The launch of BUSD was met with positive reception from the community. It expanded its trade to several dozen different USD pairs. Its incredible performance has maintained its intended 1:1 ratio with the USD. Here are some of its benefits: BUSD remains one of the few regulated crypto tokens on the market. This is because of its partnership with Paxos. Paxos is a trusted name in the crypto market dedicated to building a genuinely secure and regulated token in the crypto space. BUSD has received approval from the NYDFs, one of the most infamously strict regulatory bodies in the crypto market. It is a transparent stablecoin market. The token has maintained a stable price and is regularly and openly audited. It is also highly scalable. It can be transferred between Ethereum and Bitcoin blockchains, two of the most notable names in the crypto space. This has supported its continued market domination

The USD stablecoin from Binance.CryptoLists.com

It is a cryptocurrency issued by a digital asset trading firm known as Binance. As mentioned earlier, it's pegged 1:1 with the US dollar which means that one BUSD is equal to one US dollar. Interestingly, when Binance decided to launch their stablecoin, they had already designed their blockchain (Binance Smart Chain) and their native token (Binance Coin). BUSD can run on the Binance Smart Chain because it adheres to the BEP-2 standard. However, it was built on Ethereum's network; therefore, it classifies it as an ERC20 token.

Utility of Binance USD?

At first, Binance USD was created to serve the corporate interests of Binance instead of solving the issues that the preceding stablecoins were experiencing. Regardless, they managed to solve the underlying trust issues with the preceding stablecoins such as USDC and USDT.

There exists an elaborate procedure to make sure that it complies with the regulatory frameworks established by the body that supplies the US dollar itself. BUSD is made in partnership with Paxos which is also BUSD's issuer.

Binance USD Price details

BSC Contract address: 0xe9e7cea3dedca5984780bafc599bd69add087d56

›› Details & Tokenomics

›› BUSD tokenomics and social media

Advantages of Binance USD

+ The stablecoin from the world's biggest crypto exchange.

+ The stablecoin from the world's biggest crypto exchange.+ Low transfer costs.

+ BUSD is a good alternative to avoid crypto price fluctuations.

+ Suitable for huge trading volumes.

Disadvantages

- You still take a currency risk with BUSD, since it's pegged to USD.

- Strong competition from pioneers such as Tether, and from USDC.

- Fiat currency transactions are not accepted.

Costs

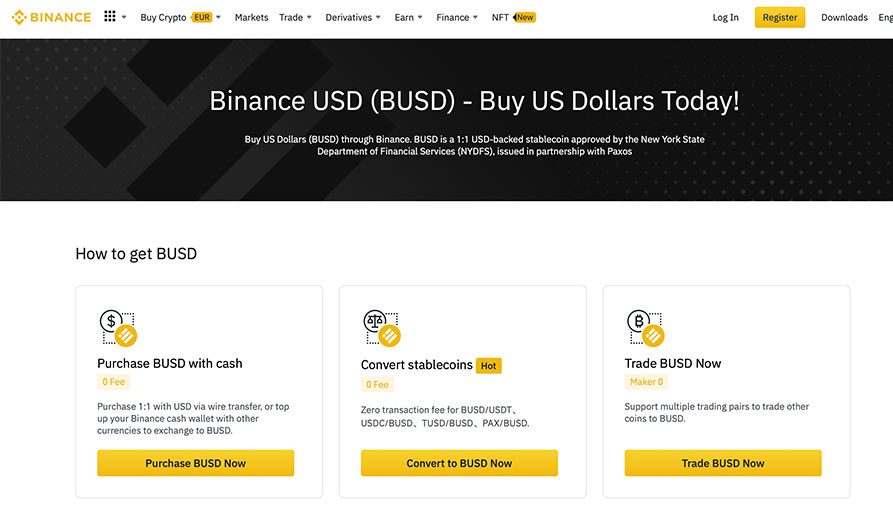

▪ Rated at 10/10According to CoinMarketCap, 1 BUSD is equal to $1 as of February 2022. It has a daily trading volume of over $4 billion and a market capitalization of $16.1 billion. Binance has a promotion known as Zero Maker Fee which allows traders to transact the crypto for free. Here are some of the services that are offered for free:

+Buying with cash.

+Converting stablecoins.

+Trading.

Few other exchanges got even close to such good deals. So try Binance yourself today!

Reputation and Buzz

▪ Reputation rated at 9/10▪ Buzz rated at 9/10

Binance USD has a strong reputation as a company that's highly secure and compliant. However, compliance and security come at a price – it's centralized. Decentralized finance's die-hard fans often see it as a threat to the cryptocurrency space.

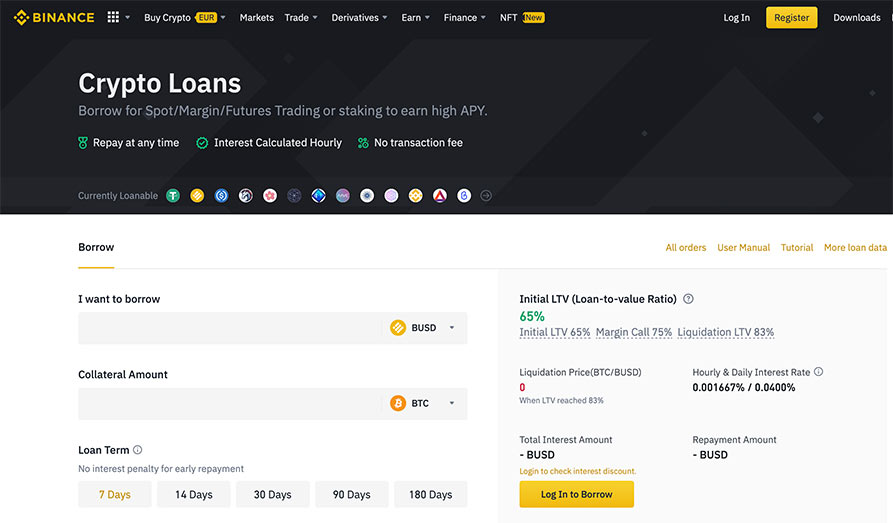

Although the stablecoin has been accepted widely, for example, as collateral for leveraged transactions, the financial activities involving Paxos and Binance USD are likely to be monitored. There is a disconnect between people who use a regulated stablecoin on common decentralized exchanges such as Uniswap.

FAQ

What blockchain does Binance USD use?

BUSD is transacted on the Ethereum blockchain network similarly to other ERC-20 tokens. What happens is that anyone looking to redeem their BUSD can send the token to a Paxos-controlled address. From there, the token will be burned, and its corresponding fiat currency amount will be transerred from the Paxos reserve accounts to the user’s account. BUSD can also be transacted through Bitcoin blockchains.

What is the highest value Binance USD ever had?

The highest value Binance USD has ever reached is 1.05. This was on 13th March 2020. However, in a short time, the value went down again.

How can you buy BUSD with crypto?

You can buy BUSD with a cryptocurrency like Bitcoin, BNB, Ethereum, and Litecoin. All you have to do is sign up on the Binance platform and send your crypto to your account. You can check out the supported cryptos on the wallet screen. Once you have selected a coin from the list, you can click the ‘deposit’ button and see the address to send your crypto to Binance. From there, you can copy the address and paste it into the wallet and send it. Your funds will show up in your exchange balance in a few minutes, depending on the blockchain used.

Is BUSD secure and stable?

Yes. One of the best things about this token is its stability and safety. The Paxos Trust Company is the custodian and issuer of BUSD. Its association with Paxos has a significant role to play in its safety. The token is also regulated, something that many companies in the cryptocurrencies space have not achieved.

Screenshots from Binance USD

Related crypto site? Learn more about Binance

BUSD is a utility token for the exchange Binance, so it's worth reading more about the company behind below.

BUSD is a utility token for the exchange Binance, so it's worth reading more about the company behind below.Binance is a crypto-exchange platform founded by Changpeng Zao in 2017. The founder initially set it up in China but soon moved to Japan and later the Cayman Islands due to increased regulation from the two governments. However, it didn't stop them from growing. In 2 years, Binance grew to be the biggest crypto-exchange platform globally...

›› Read our full Binance review here or more directly at their website here.

Largest on crypto. Over 200 cryptocurrencies to trade, both currency exchange with a wallet, CFD trading, staking and much more.

›› Sign up at Binance here

More sites where to buy/sell/trade Binance USD

Below you can see some other platforms, exchanges and/or brokers where you can buy, sell or trade this token. Click on the logo to read our review.Remember to never risk money that you can not afford to loose. Crypto currencies is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Binance USD details and tokenomics

ERC20 Contract address: 0x4Fabb145d64652a948d72533023f6E7A623C7C53

ONE Contract address: 0x19860CCB0A68fd4213aB9D8266F7bBf05A8dDe98

Binance to phase out BUSD by February 2024

Binance to phase out BUSD by February 2024