Popularly identified by the ticker USDC, USD Coin is a digital stablecoin that is pegged to the United States Dollar on a 1:1 basis, meaning that every single unit of this cryptocurrency is backed by $1 in terms of cash reserves or treasury bonds. USDC is issued by a private entity and is not a central bank digital currency. The consortium that manages USDC is a peer-to-peer (P2P) services company called Centre and was founded by two members, Circle, and also by Coinbase cryptocurrency exchange coinbase. The USDCs that are currently in circulation can be found on the Ethereum blockchain, and are known as ERC-20 tokens

A Bit About USDC

Before you can understand the full dynamics of USDC, you need first to grasp the concept of stablecoins. Stablecoins can only function effectively when more stable assets like fiat currency receive back up. They play the role of minimizing administrative load and any fees or charges that an investor incurs when converting digital assets into fiat. These are just a few basic things you need to understand before you jump on USDC.

What is USD Coin?

USD Coin is a fiat-backed coin that operates under the value of the U.S. Dollar. It is a crypto coin that supports Coinbase and Circle Internet Financial. It uses an Ethereum-blockchain technology ERC-20 token. It is also the only Stablecoin that has support from Coinbase. For the USD Coin to remain an actual dollar, over time, it is audited. Hopefully, the team behind USDC also look into any comments by the auditors so it always stays up to date. Investors can purchase this crypto coin from platforms such as Kraken or Coinbase in the shortest time possible. Additionally, investors can trade USDC with other investors who have ETH wallets within a minute since it is an ERC-20 token. USD Coin is very popular among the DeFi community because you can use USDC with ETH Blockchain-based dApp.A stablecoin based on USD, created by Circle and Coinbase.CryptoLists.com

Why Care about USD Coin?

There are numerous reasons for you to invest in USDC. It has amazing characteristics that make it an excellent option for investors. Therefore, read below to find out more: 1. Transparency and Security USD Coin uses two reputable companies, Coinbase and Circle, to offer transparency and security to its investors. Instead of depositing your fiat currency in the banks, USDC gives you a better option to hold your funds as long as you possess a private wallet. It is highly unlikely for a hacker to access your account not unless you are a big crypto investor or you are famous. Therefore, you will be sure that all your assets are safe in your private wallet. 2. It is a Better Alternative to Tether In the past decades, there have been instances when the value of Tether has been questionable. USDC offers more security and stability to investors, thus making it a better option than Tether. Voyager pays 9% interest on USDC while none Tether receives none. 3. Compatibility with dApp USD coin is an ERC-20 token and therefore, any app that uses this standard will automatically accept USDC. Ideally, any investor using USD Coin has the advantage of purchasing numerous commodities such as Blockchain-based games and many other collectibles like digital artworks. If you deposit your USD Coin assets on popular platforms like compound, you stand a chance of earning higher interest rates. Therefore, this turns out to be a better deal than depositing fiat currency in bank savings accounts.Utility of USDC?

Since we are moving to a world where cashless transactions are becoming more and more popular, the uses for USDC have definitely shown themselves. The coin has been dubbed the digital currency for the digital age, and rightfully so. The various members behind USDC say that it could shake up the decentralized finance market, and provide a safe space for crypto traders in times when volatility is high.

One of USDC's competitors is Tether, better known by the ticker USDT. They are both quite similar so it depends on your clientele if you are trying to choose between the two. If your clients are mostly traders and investors, then USDT allows them to protect their profits and stay in the markets while avoiding volatile bitcoin prices. However, if most of your customers are businesses or institutions, then you will want to use USDC to send your clients their invoices.

USDC Price details

ERC20 Contract address: 0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48

›› Details & Tokenomics

Advantages of USDC

+ It creates very good value for the whole blockchain ecosystem.

+ It creates very good value for the whole blockchain ecosystem.+ USDC is very quickly becoming the most popular stablecoin.

+ It is backed by major cryptocurrency giants.

+ USDC can be used in decentralized applications or Dapps.

Disadvantages

- USDC can incur high fees for smaller transactions, compared to banks.

- You can lose all your USDC if you accidentally share your private key.

- Other stablecoins like USDT are featured on more exchanges.

Costs

▪ Rated at 9/10The transaction fees for USDC can range anywhere from 0.1% to 0.5% in trading fees, and between 1.0 USDC to about 61.0 USDC.

Reputation and Buzz

▪ Reputation rated at 10/10▪ Buzz rated at 10/10

USDC now got almost 30% share of the stablecoin market, a steep increase from just 1-2 years ago. Circle now integrates USD Coin on the Dapper Labs blockchain called Flow. It always seems to happen a lot of buzz around USDC.

FAQ

What Blockchain does USD Coin use?

USDC uses Ethereum Blockchain technology. This type of technology is decentralized, and it permits its users to develop a wide variety of tokens and apps. You can purchase USD coins via exchanges like Coinbase and store them in an Ethereum compatible wallet.

Is it a smart idea to invest in USDC?

USD Coin is the best option most especially for traditional investors who are seeking a low-beta investment which will enable them to generate better interests than CDs.

Where can you buy USD Coin?

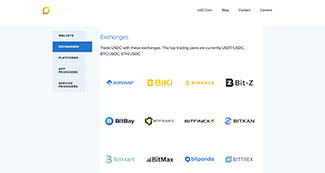

The most reliable platform you can buy USDC is Coinbase. Alternatively, you can purchase it on platforms such as Poloniex, Binance, Bitifinex and OKEx.

Is USD Coin worth it?

It is cheaper and faster to send money to any location in the world without having to have a traditional bank savings account. However, it's not real dollars so the beneficiary also need to accept USDC instead of USD.

History of USDC

September 2023 - The name USD Coin begins to be phased out and will be known as USDC exclusively.

›› Trade USDC here›› Buy/Sell USDC hereScreenshots from USDC

More sites where to buy/sell/trade USDC

Below you can see some other platforms, exchanges and/or brokers where you can buy, sell or trade this token. Click on the logo to read our review.Remember to never risk money that you can not afford to loose. Crypto currencies is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

USDC details and tokenomics

SOL Contract address: EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v

FTM Contract address: 0x04068DA6C83AFCFA0e13ba15A6696662335D5B75

USDT and USDC on Solana back on track

USDT and USDC on Solana back on track USDC adds support for Apple Pay

USDC adds support for Apple Pay  Instagram's Push Into Web3 - Enabling NFT import

Instagram's Push Into Web3 - Enabling NFT import Increased Risks For Tether (USDT) De-Pegging

Increased Risks For Tether (USDT) De-Pegging