Over the past ten years, there’s been a lot of buzz about cryptocurrencies, creating an entirely new asset class. With such innovation, questions arise and the answers often lead to further questions…

If you’re finding it difficult to understand how this digital, decentralized money is different from your good old cash or credit, fear not. You’re in the right place. We’ll break down all the ways crypto builds upon fiat, where it diverges, and what the future holds.

Let’s dive into the world of cryptocurrencies and fiat currencies, and explore their differences to help get you right up to speed before you embark on a crypto adventure!

What are Cryptocurrencies and Fiat Currencies?

Before we go any further, let’s make sure we’re on the same page about what cryptocurrencies and fiat currencies are. Cryptocurrencies are digital or virtual currencies that use cryptography for security. They’re decentralized and operate on technology called blockchain, which is a distributed ledger enforced by a network of computers, also known as nodes.

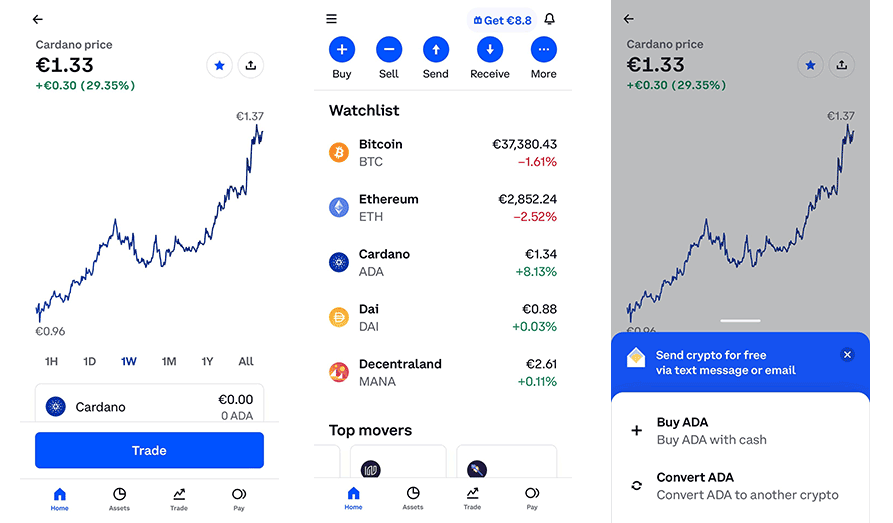

The most well-known cryptocurrency is Bitcoin, but there are thousands of others including Ethereum, Ripple, and Litecoin.

On the other hand, fiat currencies are traditional money that is issued by a central authority, like a government. This is the money that you use daily, such as the euro, dollar, pound or yen. They’re physical, but can also exist in digital form, like in your bank account.

One of the most significant differences between cryptocurrencies and fiat currencies is the lack of central authority. Unlike fiat currencies which are regulated by a central bank, cryptocurrencies are decentralized. This means that no single entity controls them. You’re in control of your money, and no government or financial institution can take it away. The value of cryptocurrencies is derived from their native blockchain, and transactions are secured and validated by users on the network.

Crypto = no intermediaries

When you send fiat money to someone, it usually goes through banks or other financial institutions. These include payment processing companies, who help to ensure the security and validity of transactions. With cryptocurrencies, transactions happen directly between the parties involved, thanks to blockchain technology. It’s like handing cash to someone, but digitally!

The decentralized nature of crypto enables these “trustless” transactions. The absence of a central authority results in higher volatility, as cryptocurrency values can fluctuate wildly based on market demand. However, this volatility is why crypto trading is so popular.

Rating: 9.3/10

Number of instruments: 40+ instruments

Description: Try Advanced Trade on the Coinbase site!

Risk warning: The crypto market is volatile. Don’t risk more money than you can afford to loose.

Security and Traceability

The security of cryptocurrencies comes from the cryptographic techniques they use, making them incredibly hard to counterfeit. Moreover, due to their transparent nature, transactions are traceable on the blockchain, providing a level of accountability that’s hard to match with fiat currencies.

Fiat is protected by centralized systems such as banks and governments, with established regulatory mechanisms and legal protections in place. For instance, if a bank fails or fraud occurs, customers’ deposits are insured up to a certain limit. Additionally, transactions can be reversed in cases of fraud or error.

Cryptocurrencies, on the other hand, operate on decentralized networks. While this protects against fraud and double spending, the lack of a central authority means that if digital wallets are hacked or private keys are lost, there is no recourse to recover the funds. Furthermore, cryptocurrency transactions are irreversible, so using the right destination wallet address is key!

Accessibility

Cryptocurrencies can provide access to financial services to people who are unbanked or underbanked. All you need is a smartphone and an internet connection. Fiat currencies, on the other hand, require access to banks or other financial institutions.

Fiat money, being issued and regulated by a country’s central bank or government, requires traditional banking infrastructure for operations. This implies a need for physical resources, regulations, and a degree of centralized control. In areas with limited resources or regulations, access to such banking services might be challenging, thereby restricting the accessibility of fiat currencies.

Gateway to financial freedom?

On the other hand, cryptocurrencies operate on the blockchain. This technology allows for transactions to occur in a virtual space, removing the need for physical banking infrastructure.

Cryptocurrencies can therefore be accessed in regions where traditional banking systems may not exist or are underdeveloped. It’s important to note that access to cryptocurrencies requires internet connectivity and digital literacy, which might be barriers in certain regions.

Regulation

This is where the waters get a little murky. Because cryptocurrencies are decentralized (in whole or in part), they’re difficult to regulate. While this can provide some benefits (like privacy and freedom from government control), it also makes them susceptible to use in illegal activities.

Fiat currencies, on the other hand, are heavily regulated by government institutions and central banks, which have the authority to manage monetary policy, including interest rates, money supply, and inflation. This of course provides a level of stability and security.

Different strokes…

The regulatory environment for cryptocurrencies is less clear and varies widely by country. Some jurisdictions have embraced cryptocurrencies and blockchain technology, while others have imposed strict regulations or outright bans. While this lack of regulation can promote innovation and freedom, it can also lead to increased risk and volatility. This volatility pleases some, who see crypto as a way to become wealthy quickly, whereas people with a long-term view often seek regulation such as the upcoming MiCA legislation in the EU.

Those that seek revolutionary reforms to the monetary system are usually not in favor of regulation, and hope that fiat currencies fail, with Bitcoin (usually) promoted as a global alternative. However. as cryptocurrencies become more mainstream, we can expect more regulatory scrutiny and potential new laws to protect investors and maintain economic stability.

Value Determination

The value of both fiat and crypto currencies is fundamentally determined by supply and demand dynamics, but the mechanisms through which these dynamics play out are quite different for each.

The value of fiat currency is determined by supply and demand dynamics in the market. It’s also strongly influenced by national economic indicators like inflation and interest rates. Cryptocurrencies, however, are more speculative, and their value is influenced by factors like technological developments, internal governance, and shifts in market sentiment. Let’s look a little more closely…

Fiat currency is issued by a country’s central bank and its value is largely based on the economic stability and creditworthiness of that country. The central bank has the ability to manipulate the supply of money to influence its value, typically with the goal of maintaining economic stability. For instance, during periods of economic downturn, central banks often increase the money supply to stimulate spending and boost the economy, which can devalue the currency.

Digital gold

Cryptocurrencies, on the other hand, operate on decentralized networks and their value is largely driven by speculative demand. The supply of most cryptocurrencies is fixed or increases at a predictable rate, as dictated by their underlying algorithms. For example, the supply of Bitcoin is capped at 21 million coins. This means that as demand for Bitcoin increases, its value is likely to rise since the supply cannot be increased to meet this demand.

Bitcoin, in particular, has often been referred to as ‘digital gold’. This term comes from the perception of Bitcoin as a store of value, similar to how gold has been used historically. Like gold, Bitcoin is scarce, with a finite supply, and this scarcity can make it a hedge against inflation.

To avoid any accusations of bias, it’s important to note that while Bitcoin has characteristics that make it similar to gold, it also has significant differences. Most notably, Bitcoin’s value is much more volatile than gold, which can make it a risky investment. Bitcoin’s acceptance as a form of payment is also still relatively limited, which can reduce its utility as a store of value.

Types of Currency

Lastly, while there are hundreds of fiat currencies around the world, there are thousands of different cryptocurrencies, each with its unique features and uses. This diversity can offer a range of options for different uses, from buying a cup of coffee to executing complex smart contracts.

Crypto currencies have evolved significantly since the inception of Bitcoin, with over 22,000 varieties currently in existence and a total market capitalization reaching trillions at market highs. These digital currencies can be broadly categorized into coins and tokens.

Coins & Tokens

Coins, like Bitcoin and Ether, operate on their own blockchains. Bitcoin is often used as an investment vehicle, while Ether and other altcoins (alternative coins) are utilized for transactions, building services, and fostering communities.

Tokens, on the other hand, are digital assets stored on a blockchain that represent an asset or a service. They run on existing blockchains and include three primary types: value tokens, utility tokens, and security tokens. Value tokens represent a certain monetary value, utility tokens offer a specific function or access within a platform, and security tokens are investment contracts that represent the ownership of an underlying asset.

Another notable category is stablecoins, which have their value pegged to another asset’s price to maintain stability.

What Does the Future Hold?

While it’s impossible to predict the future with absolute certainty, the evolving landscape of cryptocurrencies and fiat currencies suggests several key trends. One possibility is that cryptocurrencies will increasingly integrate with traditional financial systems, offering hybrid solutions that leverage the best of both worlds. They could become more widely accepted as legal tender, as seen in El Salvador’s adoption of Bitcoin, yet their value will continue to be more speculative due to lack of central control.

Ongoing Evolution

Fiat currencies might evolve in response to the rise of cryptocurrencies, adopting more digital features while maintaining the stability and trust associated with government backing. Central banks could also issue their own digital currencies, combining the convenience and security of blockchain technology with the regulated nature of fiat money.

However, the coexistence of these two forms of currency will likely necessitate more comprehensive regulations to protect investors and maintain economic stability. The future of crypto and fiat may well be a blended one, with each complementing the other to serve a wide range of financial needs and preferences. Regardless of the path taken, the dialogue between crypto and fiat will undoubtedly continue to shape the future of global finance.

Ready to Take the Crypto Pill?

In conclusion, while cryptocurrencies and fiat currencies share the basic premise of being mediums of exchange, they differ significantly in their operations, security, regulation, and value determination. Both have their pros and cons, and understanding these differences can help you make informed decisions about your finances. After all, as with all things, knowledge is power. Be sure to check out our other crypto guides to get up to speed on all areas.