In the ongoing digital arm wrestling match between Coinbase and the Securities and Exchange Commission, it seems as if the SEC might have won a small battle.

Recent news has emerged that the commission refused to grant a request by Coinbase (see more) to create new rules for trading within the cryptocurrency marketplace.

What might this signify from a short- to medium-term perspective? Should cryptocurrency investors be running for the hills or instead adopt a watch-and-wait approach?

Let’s begin by taking a look at the rationale behind the SEC ruling as well as why this debate is far from over.

The Notion of “Existing Rules”

Let’s first roll the clocks back to July 2023 to obtain a bit of background. At the time, the SEC requested that Coinbase cease trading all cryptocurrencies within their portfolio other than Bitcoin; stating that they represented securities.

In other words, these assets fell within the jurisdiction of the SEC and Coinbase would therefore have no other choice than to comply.

It isn’t difficult to appreciate what would have happened if Coinbase had decided to pull more than 200 of its crypto tokens. This more or less would have spelled the end of cryptocurrency trading in the United States as we know it. Instead, Coinbase chose to turn to the courts in order to obtain a clearer ruling.

More of the Same?

When we now fast forward to December, not much has actually changed. Coinbase put forth yet another proposal to modify SEC regulations in relation to cryptocurrency trading and to little avail. SEC Chairman Gary Gensler cited three reasons why this request was denied

- He claimed existing securities laws apply to the cryptocurrency marketplace.

- The SEC already oversees many crypto operations throughout the United States.

- Only the SEC is allowed to determine its own rule-making policies.

Gensler went further to refer to a case as far back as 1946 (SEC v. W. J. Howey Co.). Without going into too many details, this Supreme Court decision provided investment contracts with a greater degree of flexibility. To put it another way, investment agreements were designed to adapt to different scenarios as opposed to remaining static in nature.

The SEC therefore seems to be using this ruling to justify its actions in relation to the cryptocurrency markets; stating that they fall under this very same level of flexible oversight. Simply stated, federal securities laws apply to firms such as Coinbase.

Rating: 9.3/10

Number of instruments: 39+ instruments

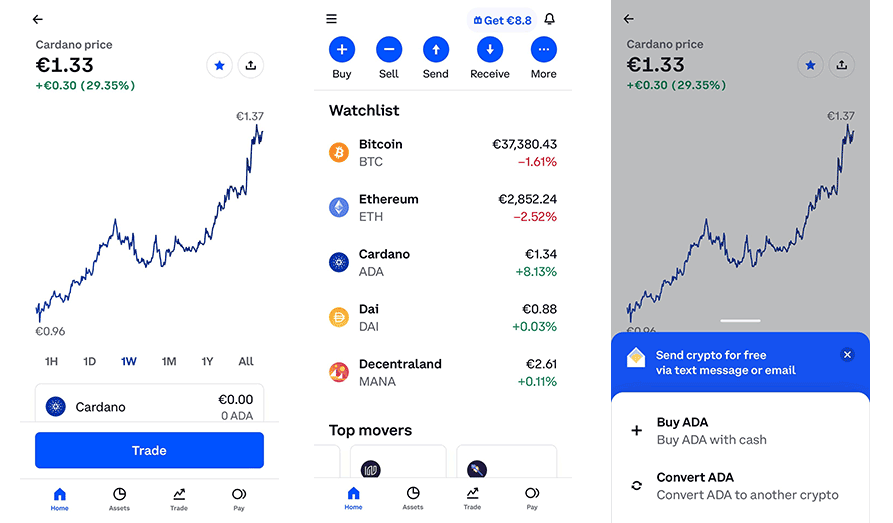

Description: Sign up to one of the best and most easy-to-use crypto platforms!

Risk warning: The crypto market is volatile. Don’t risk more money than you can afford to loose.

How Might Coinbase Choose to Respond?

At least for the moment, it seems as if the ball is once again in Coinbase’s “court”. It’s still important to remember that the SEC has already ruled against Coinbase in the past; specifically litigation claiming that (according to them), the firm is continuing to operate as an unregistered exchange. It is important to remember that this case is still ongoing and that no final decision has yet been made.

A Middle Road?

It would appear that (at least for the moment), the SEC and Coinbase are deadlocked. Public opinion seems to be equally divided. Some have cited problems with crypto exchanges such as non-compliance and fraud. Others have instead stressed that such a modern marketplace will require an entirely different set of regulatory guidelines; a position that is firmly supported by Coinbase.

The good news is that we might not yet be fully immersed within a cryptocurrency “cold war”. Some lawmakers now believe that dialog is the most important step forward. They state that the innovative technologies associated with the crypto ecosystem dictate that new laws must be drafted.

This is even more relevant when wading through the mire of issues such as custodial services, lending and borrowing (SEC-registered companies are not currently allowed to perform these actions).

Ultimately, both Coinbase and the SEC are being forced to walk a delicate tightrope. While Coinbase is determined to continue its operations, it appreciates that bad press may begin to deter investors.

On the other hand, we imagine that the SEC fully appreciates what would happen to the cryptocurrency marketplace in the United States if they suddenly forced Coinbase to cease trading entirely.

2024: A Landmark Year

The bottom line is that this debate cannot go on forever. It’s likely that we’ll see some type of resolution in the coming year.

Whether this favors exchanges such as Coinbase or it ‘ll instead involve massive SEC oversight throughout the entire sector is yet to be determined. Either way, Crypto Lists will keep our readers informed.