Stablecoins are an essential element in the crypto-verse, where many have asked for increased regulation.

These coins are cryptocurrencies that are pegged to the market value of an external source such as the USD or gold. Several of them are pegged in the ratio 1:1 with the external resource serving as collateral to the crypto.

The main purpose of stablecoins is to minimise the effects of the volatile nature of cryptocurrencies. The unreliability of crypto is what limits its usage in the payment of goods and services. These coins supply are within the regulation of an algorithm.

The FSB stand on Regulation of Stablecoins

Go directly to

Recently, the Financial Stability Board (FSB) highlighted concerns about cryptocurrencies. FSB reported a threat to the global financial system and the need to regulate stable coins. The regulatory body admits the explosion of these coins into the financial system. It is no longer only used in the crypto-verse for trading. Several stakeholders are accepting them for payments of goods and services. It includes both domestic and international payments.

Increased market cap and legal tender in Lugano

There has been a significant increase in the market capitalisation of stablecoins. It has witnessed growth to over $157 billion by the year-end of 2021. This is from just 5.6 billion USD within two years. These coins have over 20% of the USA assets in the institutional and retail money market funds. Tether’s, USDT, is amongst the largest of these coins. Its market capitalisation has grown significantly nearing notable, large money market funds. This only increases the need for regulatory compliance and risk management of these reserve assets – unless you live in Lugano, Switzerland. Since yesterday, the “plan B” (plan for Bitcoin) has rolled out in Lugano, making it legal tender and now you can even pay taxes with stablecoins or with Bitcoin there.

BREAKING NEWS: #Bitcoin , #Tether & the City's LVGA token will become de facto LEGAL TENDER in Lugano #LuganoPlanB pic.twitter.com/gvZKKRveOI

— Tether (@Tether_to) March 3, 2022

FSB demand regulation

A potential run on the coins could have adverse effects on the global financial system. FSB insists there has to be regulation of the redemption rights of the coins holders. A sudden loss of confidence in the coins could lead to a run. There would be a subsequent effect of disruptions on investments of the reserved asset, and increased sale of the asset. They face the same risks as any payment method. They are prone to liquidity risk, credit risk, and operational risk.

The US Draft Bill on the regulation of stablecoins

Josh Gottheimer, the New Jersey Rep, recently revealed an early draft bill on the regulation of stablecoins. He proposes to have particular cryptocurrencies as qualified coins. This is on the condition that they are pegged and redeemed in a 1:1 ratio with the US dollar. The qualified coins are to be issued by a federal bank or a non-bank financial institution that maintains all reserve assets of US dollars. If not the US dollar, it could maintain an asset that is agreeable with the Office of the Comptroller of currency to be cash collateral. The New Jersey rep continues to engage with Treasury and the Blockchain Association to support his plan. Bloomberg reports that the treasury says legislation is urgent for stablecoin.

![]()

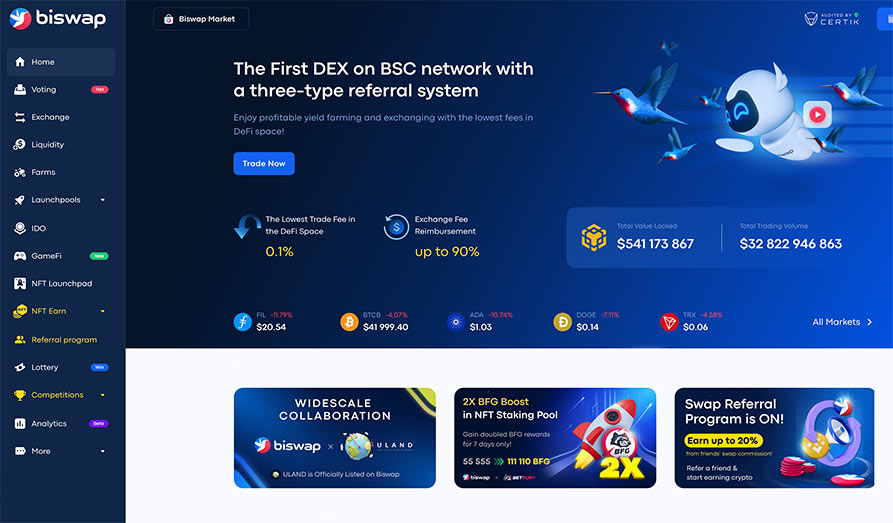

Rating: 9.43/10

Number of instruments: 155+ instruments

Description: Find the best stablecoins for investment at Biswap. Try a great DEX today!

Risk warning: Trading, buying or selling crypto currencies is extremely risky and not for everyone. Do not risk money that you could not afford to loose.!

The proposed bill aims to regulate the coin while still maintaining innovation in the cryptocurrency market. These coins provide stability to the fast and volatile cryptocurrencies using fiat currency such as USD. Just like the FSB, the bill is wary of increased redemption requests that end up causing a run. Issuers of the coin continue to withhold dollars to leverage the value of their crypto but do not guarantee all redemption requests. This could result in an onset of domino insolvency.

The bill proposal is within the same period as when Washington seeks to regulate the crypto-verse. The administration has been working with regulatory agencies on avenues to limit the systemic risk of stablecoins. the President’s Working Group on Financial Markets proposed restricting issuing the coins to banks insured by the Federal Deposit Insurance Corp. It would allow the government intervention as the need arise. However, the proposal was majorly declined by industry players. The argument was the best coins are not issued by bank institutions.

Will Wyoming get their stablecoin?

More recently, the lawmakers of Wyoming are of the position that the government should develop its stablecoin in line with the regulation push. Caitlin Long from Wyoming reported that legislators proposed a bill for State of Wyoming to issue a stablecoin. Here is the official Wyoming stable token act (#SF0106).

Crypto Lists facilitate this information with the most updated facts and events in the crypto-verse. You can find a top list of stablecoins, include in-depth reviews of important instruments such as:

Binance USD (BUSD)

Dai (DAI)

Gemini Dollar (GUSD)

Pax Gold (PAXG)

Terra USD (UST)

Tether (USDT)

USD Coin (USDC).